Mastering Your Retirement: A Personalized Guide to CPF Planning

As we approach the golden years of our lives, the thought of retirement can be both exhilarating and daunting. I remember sitting down with my grandmother one evening, her eyes twinkling as she recounted her adventures, and wishing she could have enjoyed those years without financial stress. That evening marked the beginning of my journey to understanding how to ensure a comfortable retirement, especially through tools like CPF that I’d previously overlooked. Planning for retirement doesn’t have to be a chore; let’s break it down together!

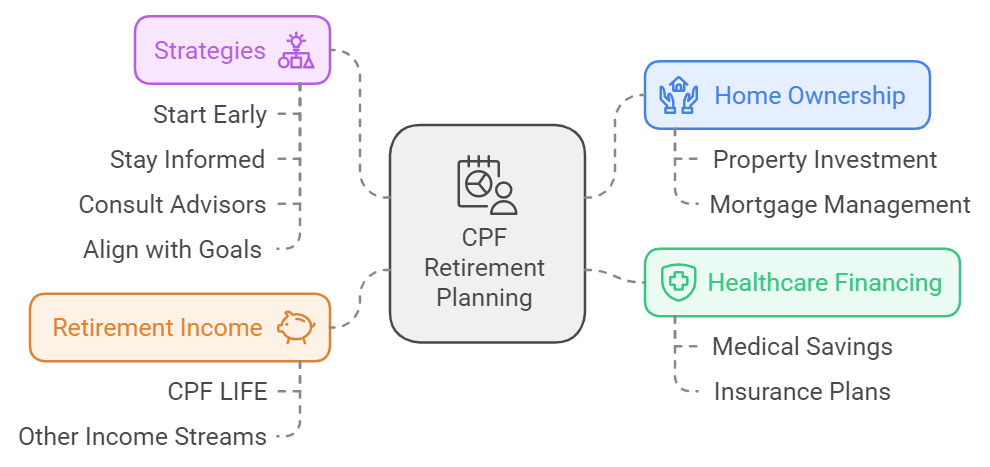

Understanding CPF and Its Role in Retirement Planning

What is CPF and How Does It Work?

CPF stands for the Central Provident Fund. It’s more than just a savings plan; it’s a lifeline for Singaporeans. CPF is a mandatory savings scheme that requires working citizens and permanent residents to contribute a portion of their salary. This money goes into various accounts serving different purposes.

How does it work, you ask? Your contributions are split into three accounts: the Ordinary Account, the Special Account, and the Medisave Account. Each of these accounts serves a different purpose, from housing to healthcare. It’s designed to give you a comprehensive safety net.

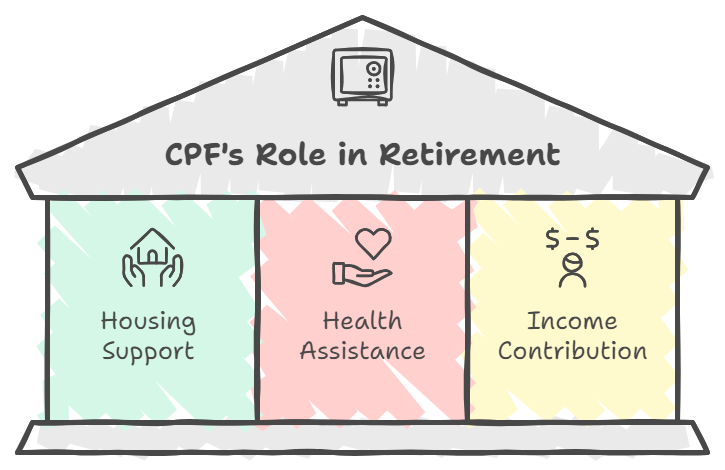

The Three Pillars of Retirement: Housing, Health, and Income

When we think about retirement, three key needs often arise: housing, health, and income.

- Housing: CPF helps you pay for your home. This is vital because having a stable place to live is crucial in retirement.

- Health: Aging can be costly. With MediShield Life, CPF assists you in managing daunting healthcare expenses.

- Income: Finally, CPF contributes to your monthly retirement income, helping you cover daily necessities.

Isn’t it comforting to know that CPF can support these needs?

Why Every Singaporean Should Utilize CPF for Retirement

Utilizing CPF for retirement is not just smart; it’s essential. Every Singaporean should see CPF as a valuable tool. Your CPF is your safety net for your golden years. It grows with interest while you work, ensuring you have what you need as you age.

Some may think, “Why bother? I can save on my own.” But the competitive interest rates offered by CPF can significantly boost your savings. Isn’t that worth considering?

Common Myths About CPF and Retirement

Let’s clear the air on a few myths:

- Myth 1: CPF is just for housing. FALSE! CPF can also support healthcare and provides monthly retirement payouts.

- Myth 2: You can’t access your funds until you’re old. NOT TRUE! There are withdrawal options post-55.

- Myth 3: You won’t have enough for retirement with CPF. If managed right, CPF can provide sufficient income.

Knowledge is power, right? Understanding CPF enables you to use it to your fullest advantage.

In conclusion, embracing CPF as a fundamental element of your retirement planning is crucial. It aids you through essentials like housing, health care, and income. By debunking myths and understanding how CPF operates, we’re setting ourselves up for a secure future.

Home Ownership: A Solid Foundation for Retirement

Home ownership is more than just a place to live. It’s a pivotal part of our retirement planning. Imagine stepping into a mortgage-free life. Isn’t that a comforting thought?

The Importance of a Fully Paid Home

Before retirement, having a fully paid home is crucial. It not only provides peace of mind but also protects you from fluctuating mortgage interests. Think about it like this: when you are debt-free, worries diminish. As the saying goes,

“Owning a mortgage-free home can provide great peace of mind.”

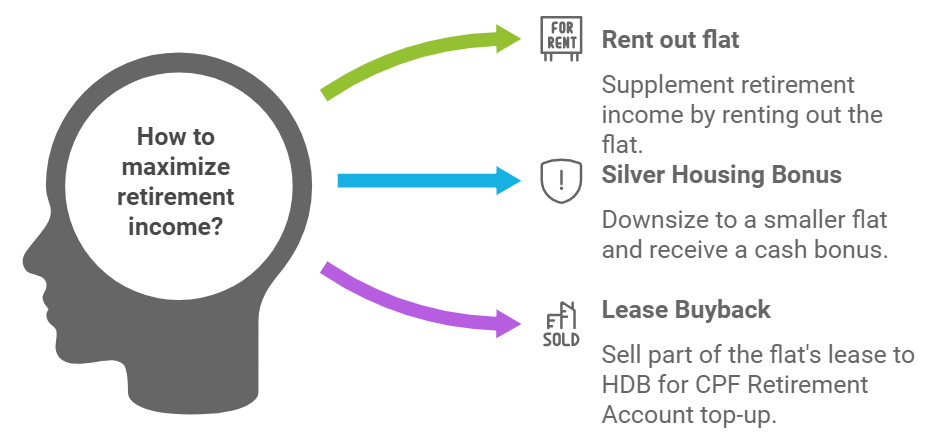

Monetizing Your Property

Besides just living in your home, there are several ways to make it work for you financially:

- Rent out a room: Consider listing a room on platforms like Airbnb. This can help supplement your income.

- Long-term renting: If you have extra space, renting it long-term can provide stability.

- Home office: If you work from home, having a designated home office can help you save on commuting costs too.

Understanding the Silver Housing Bonus

Have you heard of the Silver Housing Bonus? This scheme enables seniors to monetize their homes as they downsize. The government provides incentives, allowing homeowners to exchange larger properties for smaller, more manageable ones. Also, there’s the lease buyback scheme, which helps older owners transform their housing equity into a steady income stream. How clever is that?

My Parent’s Experience

Let me share a personal story. My parents recently sold their flat and used the proceeds to buy a smaller home. It was a bittersweet moment. They had all those memories wrapped up in the walls of that old flat. Yet, they didn’t have to stress about a mortgage anymore. The extra cash? They’re using it to travel and enjoy their golden years. It’s a great example of how

“Home equity can be transformed into retirement income.”

Prioritizing a fully paid home can bring tremendous security to our retirement plans. It’s worth considering all the options available as we navigate this journey together.

Health Care Financing: Preparing for Rising Costs

The Role of MediShield Life

MediShield Life is a health insurance program designed to help cover large medical expenses. Have you ever thought about how health costs can skyrocket as we age? Often, they do! This is where MediShield Life becomes your ally.

- It provides fundamental health coverage for significant medical bills, making it invaluable as we grow older.

- Knowing that this safety net exists can help you breathe easier.

MediSave: Your Savings Shield

Your MediSave account is another essential tool in this financial toolkit. How can it help? Simply put, it’s your way of alleviating healthcare expenses.

- Utilizing these savings can cover various medical costs, from routine check-ups to surgical procedures.

- Consider this: If unexpected health issues arise, having access to your MediSave can save you from financial strain.

Strategies to Minimize Healthcare Costs Post-Retirement

Planning for your health costs in retirement is crucial. What can we do to minimize these expenses? Here are some strategies:

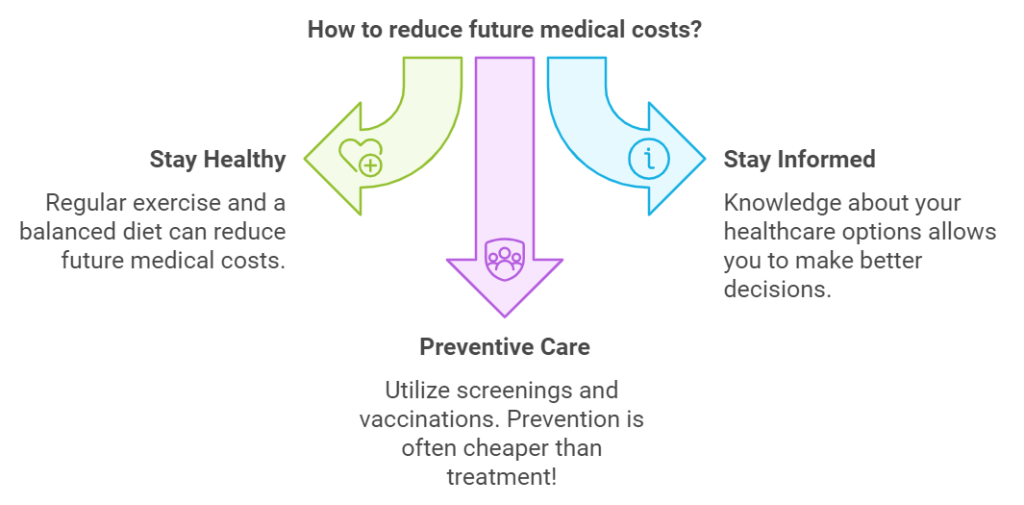

- Stay Healthy: Regular exercise and a balanced diet can reduce future medical costs.

- Stay Informed: Knowledge about your healthcare options allows you to make better decisions.

- Preventive Care: Utilize screenings and vaccinations. Prevention is often cheaper than treatment!

Dealing with Unexpected Health Expenses

Imagine this scenario: You suddenly need surgery, and you hadn’t budgeted for it. How do you handle this shock?

In moments like this, MediShield Life and your MediSave can become crucial. They can absorb much of the financial blow.

After all,

“Health is wealth, especially in retirement!”

So, having these resources at your disposal is vital.

As you grow older, it’s likely you’ll spend more on your healthcare needs. Planning ahead can save you from stress and financial burden.

Retirement Income: Calculating What You Need

When it comes to retirement, we all have one thing in common: the desire for a stable income without worries. Understanding CPF Life is crucial. It’s Singapore’s national longevity insurance, designed to provide you with monthly payouts regardless of how long you live. But how much do you truly need? Let’s break that down.

Understanding Your Monthly Expenses

How much do you really need each month to cover your expenses? It’s a question I ponder often. Think about essentials like food, transport, and healthcare. If you underestimate this amount, you risk running out of money too soon. On the other hand, overestimating can lead to unnecessary savings adjustments and stress.

It’s like packing for a trip. If you take too many clothes, you weigh yourself down. If you don’t pack enough, you could end up buying things you already have at home.

Consequences of Miscalculating

- Underestimating expenses might leave you in a tight spot.

- Overestimating could result in financial stress during your earlier years.

One of our greatest fears is outliving our savings. With CPF Life, however, we have a safety net.

Example Calculations

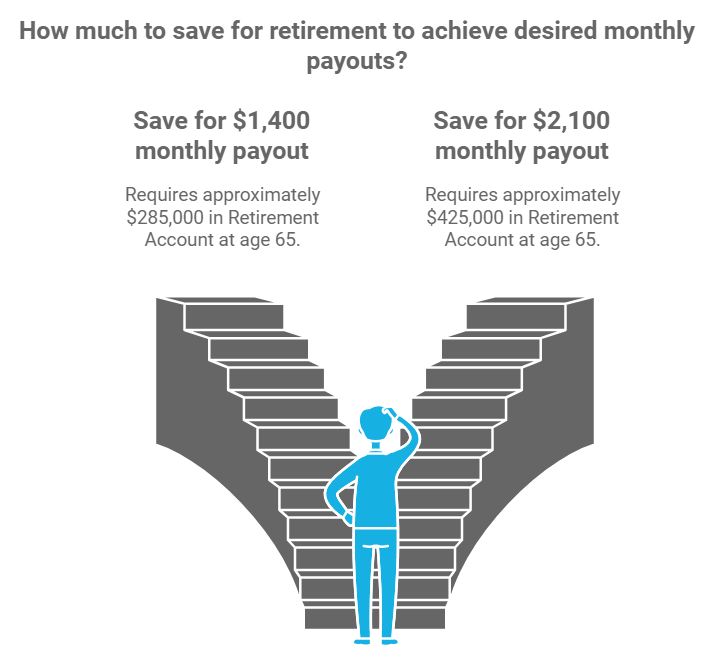

Let’s dig into the numbers. At age 65, if you desire a monthly payout of:

- $1,400, you need approximately $285,000 in your CPF account.

- $2,100, you’ll require around $425,000.

These figures may seem daunting, but they provide a clear target to aim for. We can create a strategy around these goals.

| Monthly Payout | Required CPF Savings at Age 65 |

|---|---|

| $1,400 | $285,000 |

| $2,100 | $425,000 |

By starting early or making necessary adjustments, you can ensure that these amounts are not just numbers on a page. They can become a reality through consistent saving and smart financial decisions.

Plan Ahead

As we embark on our financial journeys, it’s vital to remember that proper calculations today can minimize stress tomorrow. So whether it’s adjusting your savings, exploring alternative income sources, or simply learning more about CPF Life, every step counts. Each of us can take control to secure our futures, one calculated step at a time.

Smart Strategies to Enhance Your CPF Savings

When it comes to planning for retirement, every dollar counts. That’s why enhancing your Central Provident Fund (CPF) savings is crucial. Here are some smart strategies to help you maximize your contributions and prepare for a more secure future.

1. Tips for Increasing CPF Payouts

One of the best ways to increase your CPF payouts is by *reducing outflows* and *maximizing contributions*. Here are a few effective methods:

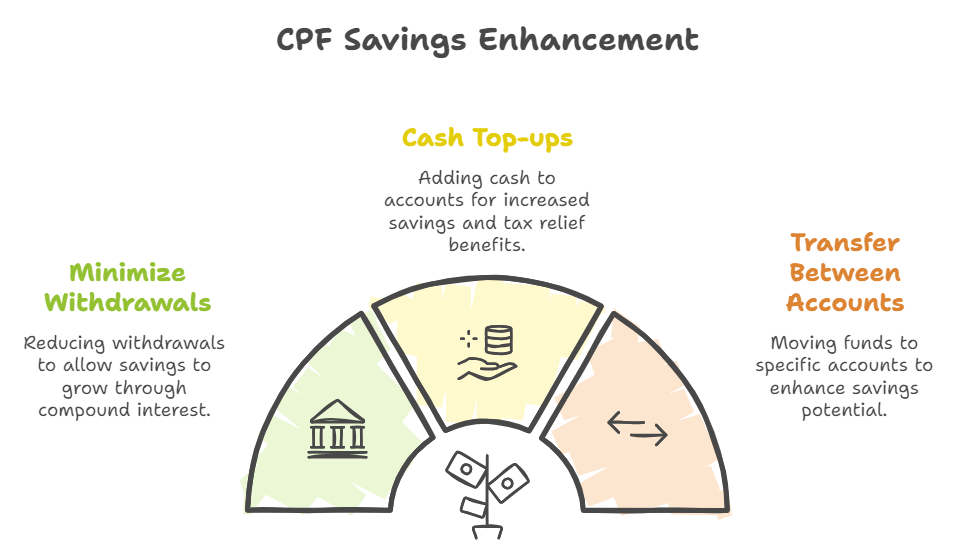

- Minimize Withdrawals: The less you take out of your CPF, the more you can grow your savings over time. Every dollar retained earns compound interest.

- Cash Top-ups: Consider topping up your Special or Retirement Accounts. Not only do these top-ups enhance your savings, but they also provide tax relief up to SGD 8,000 annually.

- Transfer Between Accounts: You can transfer funds to your Special Account or Retirement Account to increase your savings potential. Just remember, once transferred, those funds are stuck until payout age.

2. The Impact of Deferring Payouts

Have you thought about delaying CPF payouts? Deferring them can lead to significant benefits. When you postpone your payouts, your monthly income can increase substantially. In fact, for every year you delay, you can earn up to a 7% higher payout! Isn’t that worth considering?

3. Understanding Tax Relief

It’s essential to grasp how tax relief works regarding CPF contributions. You can enjoy valuable benefits for contributions made for yourself and your loved ones. Tapping into this can bolster your retirement funds without diminishing your taxable income. It’s about working smarter, not harder.

“The earlier you start planning, the more secure your future will be.”

Final Reflections on Retirement Planning

As we consider these strategies, let’s not forget the importance of having a solid retirement plan. We all hope to live comfortable lives in our later years. Failing to plan can lead to stress and uncertainty, especially as costs of living continue to rise.

In conclusion, investing early in your CPF and making informed decisions will pay off. The sooner you start, the better. Remember, your CPF savings are not just numbers; they are the foundation of your future.

So, let’s take action today. Your future self will thank you!