Planning for Your Retirement with CPF – Part 1 (Growing Your Savings)

Source: https://www.youtube.com/watch?v=PfzgL8mWLsc

Planning Your Retirement with CPF: A Comprehensive Guide

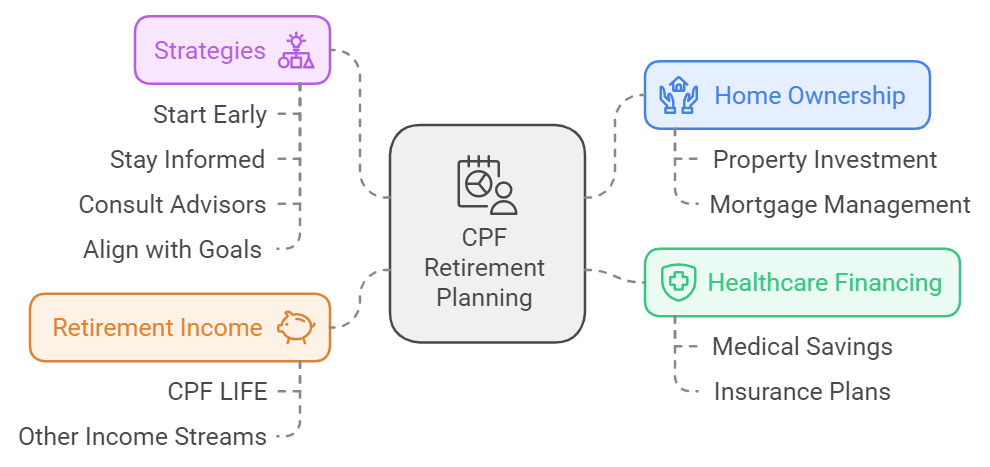

Retirement planning is a crucial aspect of financial management, and for Singaporeans, the Central Provident Fund (CPF) plays a pivotal role in ensuring a secure and comfortable retirement. In a recent video by Caroline from the CPF Board, she delves into how CPF can support your retirement needs, focusing on three main areas: Home Ownership, Healthcare Financing, and Retirement Income. Here’s a succinct summary of the key takeaways and insights from the video, along with additional context and analysis to help you better understand and plan your retirement with CPF.

Home Ownership: A Foundation for Peace of Mind

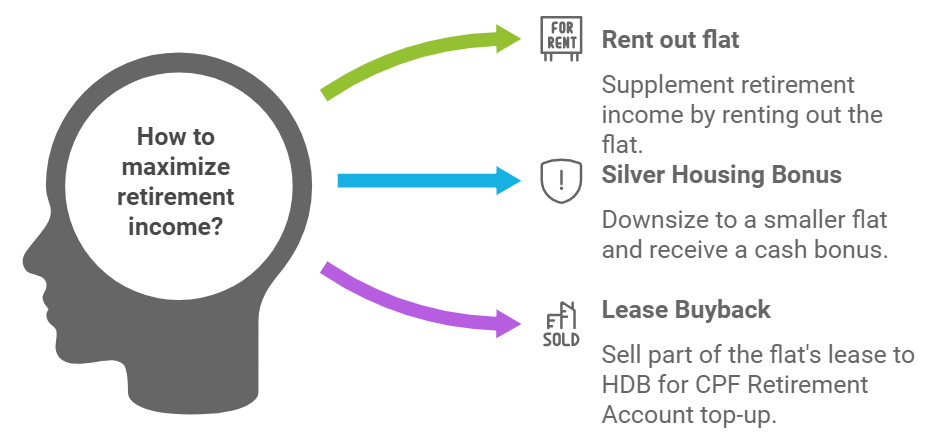

One of the primary pillars of retirement planning is ensuring that your home is fully paid off. This eliminates the worry of mortgage payments or fluctuating interest rates during your retirement years. Caroline highlights several strategies to leverage your home for retirement:

- Renting Out Your Flat: You can supplement your retirement income by renting out your flat, either partially or fully.

- Silver Housing Bonus: By downsizing to a smaller flat, such as a 3-room unit, you can receive a cash bonus under the Silver Housing Bonus scheme.

- Lease Buyback Scheme: This allows you to sell part of your flat’s lease back to the Housing & Development Board (HDB), with the proceeds topped up to your CPF Retirement Account, ensuring lifelong payouts through CPF LIFE.

Healthcare Financing: Preparing for Medical Needs

As we age, healthcare expenses tend to increase. CPF provides robust support through MediShield Life, a health insurance scheme that helps cover large medical bills. Additionally, you can use your MediSave savings to pay for various healthcare expenses, ensuring that you are financially prepared for any medical needs that may arise.

Retirement Income: Ensuring a Steady Stream

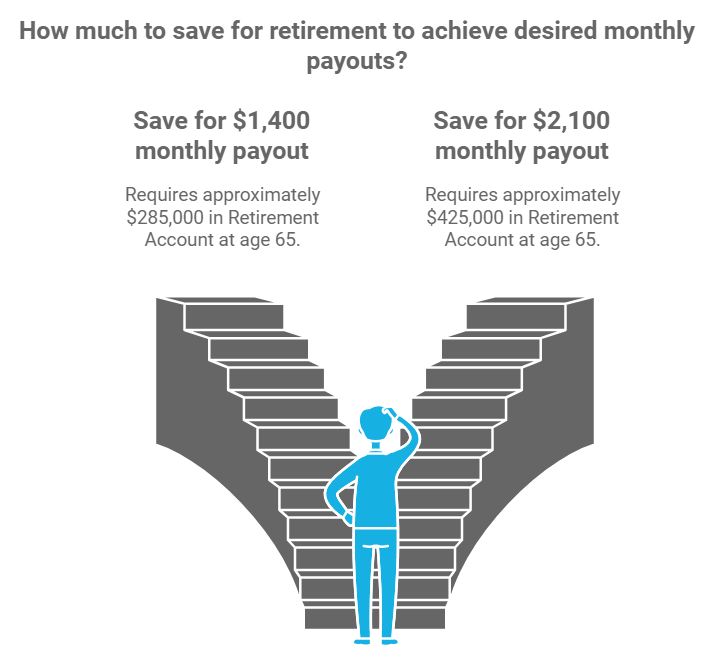

The cornerstone of CPF’s retirement support is CPF LIFE, a national longevity insurance annuity scheme that provides monthly payouts for as long as you live. Here’s how it works:

- Retirement Account Creation: At age 55, a Retirement Account is created using your Special Account and Ordinary Account savings to set aside your retirement sum.

- Monthly Payouts: From age 65, you start receiving monthly payouts. The amount depends on the savings in your Retirement Account. For instance, to receive about $1,400 monthly, you need approximately $285,000 in your account at 65. For $2,100 monthly, you need around $425,000.

Maximizing Your CPF Savings: Tips and Strategies

Caroline shares three valuable tips to enhance your monthly payouts and make the most of your CPF savings:

- Reduce CPF Outflows:

- Pay Off Your Mortgage: Consider paying off your mortgage before retirement or using cash to service your loan, reducing outflows from your Ordinary Account.

- Avoid Risky Investments: Unless you are confident that your investment returns will exceed 4% per annum, it’s safer to leave your savings in the Special Account, which earns a minimum of 4% per annum.

- Partial Withdrawals: Instead of withdrawing all your savings at once, consider partial withdrawals to continue earning attractive interest rates.

- Retirement Sum Topping-Up:

- Cash Top-Ups: Boost your retirement savings by topping up your CPF Special Account (if below 55) or Retirement Account (if 55 and above). Cash top-ups also offer tax relief of up to $8,000.

- CPF Transfers: Transfer funds from your Ordinary Account to your Special or Retirement Account to earn higher interest. However, plan carefully as these transfers are irreversible.

- Defer Your CPF Payouts:

- Increase Monthly Payouts: By deferring your payouts beyond age 65, you can increase your monthly payouts by up to 7% for each year of deferral.

Government Support Schemes

The government has introduced several schemes to further support retirement planning:

- Matched Retirement Savings Scheme (MRSS): Launched in 2021, this scheme provides a dollar-for-dollar matching grant for top-ups to your Retirement Account, up to an annual cap of $600.

- Silver Support Scheme and Workfare Income Supplement Scheme: These schemes offer additional financial support to senior Singaporeans, ensuring greater assurance in retirement.

Conclusion

Planning for retirement with CPF involves a multifaceted approach, focusing on home ownership, healthcare financing, and ensuring a steady retirement income. By leveraging the various schemes and strategies discussed, you can maximize your CPF savings and enjoy a secure and comfortable retirement. Remember, the key to successful retirement planning is to start early, stay informed, and make strategic decisions that align with your long-term financial goals.

For more detailed information and personalized advice, consider consulting with a financial advisor or visiting the CPF Board’s official website. Stay tuned for part 2 of our Planning Your Retirement series, where we’ll delve deeper into CPF LIFE and other retirement planning tools.